Bridging Finance has proved to be a particularly useful product for our clients because of the flexibility, speed of completion and improved pricing in the marketplace over the last few years.

Due to our diverse panel of lenders we’re in the fortunate position to offer our clients both unsecured and secured bridging facilities.

The below guide will set out exactly what to expect from Bridging Finance and how this product can assist your business.

What are the Types of Bridging Finance Out There?

Unsecured Bridging –

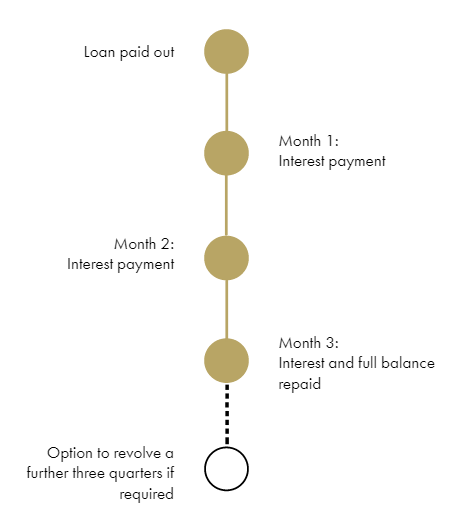

Capped at a max lend of 250k our unsecured bridging facility provides businesses with a short-term interest-only facility to help them reach the next step.

A bespoke, revolving 3 month facility which we have secured specifically for Acorn Business Finance clients, the facility can be revolved up to 3 times.

At the end of the 4th quarter, if you’re not quite ready to repay the capital, you have the option to repay it over a further 12 months (capital and interest).

There is also the option to revolve a further 12 months on top of that, if for any reason you cannot pay after the first year.

Secured Bridging –

For deals ranging from £200k – £25m over a max term of 18 months secured bridging finance is a bespoke solution which is assessed individually rather than just pricing according to Loan To Value.

And once offered, the rate will remain fixed for the term of the loan period.

Would You Like FREE Industry Insider Know-How?

What can Bridging Finance be used for?

Bridging finance can be used for a variety of property related criteria:

- Buying uninhabitable property.

- Funding renovation/restoration work.

- Purchasing a property under its’ market value.

- To invest in buy-to-lets.

Tip: Always request a breakdown of the cost of the loan from your lender. There may be hidden fees such as ‘exit fees’ , ‘valuation fees’ or ‘fund management fees’ that may not be disclosed upfront. Don’t always focus on the lowest interest rate as this may be bumped up by these hidden costs, always look at the total cost of the loan.

Benefits

- Can be used for large amounts, up to £25m.

- Often can be used to purchase property that would not be possible to buy using other finance options.

- The competitive market is leading to a reduction in interest rates.